MNSAVES: The Minnesota Way to Save for College As a mom of two teens, I think a lot about what college will look like for them—and for so many families right now, one word comes to mind: expensive. When I went to college, I had no savings and paid my own way through school. I […]

Savings on Exterior Maintenance to Fund Your Next Vacation

Dreaming of a vacation but don’t know how to fund it? One effective method is to save money on exterior maintenance of your home. By strategically choosing where and how to invest in your home’s upkeep, you can create savings that can be directly allocated to your vacation fund. Investing in High-Return Home Improvements Home […]

3 Things That May Be Costing You and Your Family More Than You Realize

It’s often easy to overlook everyday expenditures that gradually add up over time, subtly affecting your family’s financial stability. While some expenses are evident, others may be less conspicuous, quietly draining resources from your household budget. In this article, we will explore three specific areas of expenditure that might be costing you and your family […]

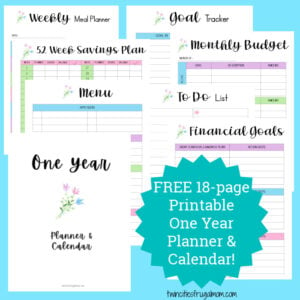

Free 18-page One Year Printable Planner & Undated Calendar

Plan your best year yet with my FREE 18-page, One Year Printable Planner & Calendar! You can use it anytime – now in January 2025 or later – and print it again and again for future years. It’s exclusive – only for YOU! You can print out 1 page or all 18 pages or whatever […]

Is Moving the Best Decision for My Family?

Moving to a new home is a significant decision that can impact every member of your family in various ways. It involves careful planning, emotional preparation, and an understanding of the potential benefits and challenges. Let’s explore some considerations to help determine if moving is the best decision for your family. What are the potential […]

How Can a Divorce Impact My Retirement Savings?

If you’re facing a divorce, you’re not alone. About 2.3 per every 1,000 people in the U.S. become divorced. Divorce is a big deal—it’s not just about emotions but also about money, especially when it comes to your retirement savings. Things like your 401(k) plans and IRAs are considered fair game in a divorce, so […]

How to Manage Your Family’s Expenses to Increase Your Disposable Income

Cutting the proverbial fat from your budget is an easy way to increase your disposable income. When trying to take control of your finances, it’s imperative to learn some of the many ways in which you can cut down on your expenses. By proactively budgeting and spending, you can optimize your finances and make the […]

5 Ways You Can Improve Your Personal Finances at Home This Year

If you want to protect your family and your home from hardship, it is very important that you take care of your personal finances. While it is normal to have some struggles with money, you should take steps to ensure that you are living a financially healthy life. If this is one of your goals […]

Tips and Tricks for Improving Your Business Finances This Year

When it comes to managing your business finances, it can be tough to know where to start. With so many factors and priorities to consider, it can be easy to feel overwhelmed and unsure of the best approach. But the good news is that there are plenty of tips and tricks out there that you […]

How to Budget for Unexpected Off-Days from Work

Budgeting for unexpected time off from work is the same as budgeting for unexpected expenses. You have to have a budget in the first place to cover for the times you are sent home without pay. There are a lot of reasons you may have to miss work unexpectedly and lose some income. Having a […]

- 1

- 2

- 3

- 4

- More Posts »