How Our Family Scored 4 Free Plane Tickets Using Credit Card Points!

Traveling as a family can be expensive, especially when it comes to airfare. But what if I told you that our family of four flew across the country for free—just by using credit card points? It might sound too good to be true, but with a little planning and strategy, we made it happen.

Here’s how we did it and how you can do the same.

Choosing the Right Credit Card

I already had a Wyndham credit card, which had given us free hotel rooms in the past. But I wanted a card that offered points for other travel expenses like airline tickets.

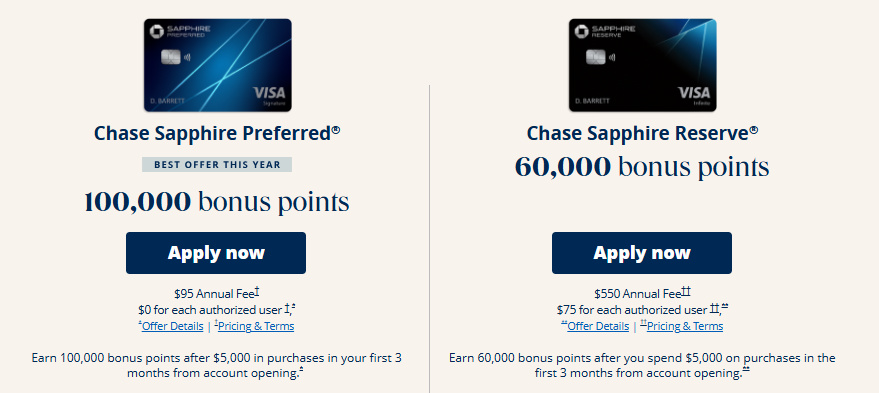

After researching different travel reward credit cards, I decided to apply for the Chase Sapphire Preferred. This card is known for its generous sign-up bonus and flexible travel rewards. One of the biggest perks was the 60,000 bonus points we could earn after spending $4,000 within the first three months of opening the account. That’s a lot of points—enough to cover flights for our entire family!

And right now they are offering 100,000 bonus points, if you spend $5000! Grab it while you can!

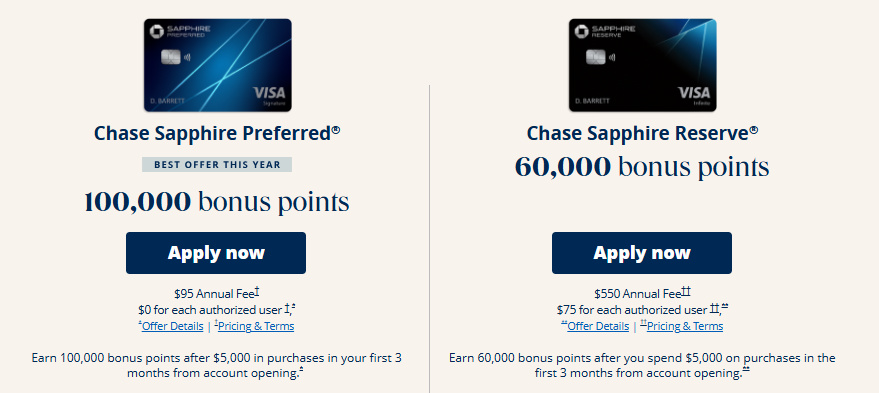

There are 2 cards – The Chase Sapphire Preferred with a $95 annual fee, and the Chase Sapphire Reserve with a $550 annual fee. Each offer different added perks but the $95 annual fee one is just fine, plus that one is offering 100,000 in bonus points right now. Plus that fee is worth it compared to what you’ll earn in free travel! (Use my referral link here!)

There are 2 cards – The Chase Sapphire Preferred with a $95 annual fee, and the Chase Sapphire Reserve with a $550 annual fee. Each offer different added perks but the $95 annual fee one is just fine, plus that one is offering 100,000 in bonus points right now. Plus that fee is worth it compared to what you’ll earn in free travel! (Use my referral link here!)

Timing Our Application Strategically

I didn’t apply for the card right away. Instead, I waited until we knew we had some major purchases coming up. This made it easier to hit the spending requirement without changing our normal budget.

One of our larger planned expenses was a new set of tires for my car, which helped us get closer to the spending threshold quickly.

In addition, I added my husband as a user which helped us get to our goal faster.

Maximizing Every Purchase

Once we got the Chase Sapphire Preferred cards, we used them for everything—groceries, gas, bills, dining, and any other expenses we could charge. The key was to ensure that we were only spending money we already planned to spend, rather than making unnecessary purchases just to earn points.

To avoid any fees or interest, we paid off the balance in full every month. This is crucial when using a rewards card—if you carry a balance and accumulate interest, the benefits of the points quickly get outweighed by the extra costs.

Earning the Bonus Quickly

By the end of two months, we had reached the $4,000 spending requirement and received our 60,000 bonus points. On top of that, our regular spending on the card also earned us additional points, bringing our total balance even higher.

Redeeming Our Points for Free Flights

My dad had moved to Nevada a couple years prior and we hadn’t been able to visit him yet. Having a bunch of credit card points now, we had the perfect opportunity to fly our whole family out there for free.

Once the bonus points hit our account, it was time to book our flights. We used Chase’s Ultimate Rewards travel portal, where points can be redeemed for flights, hotels, and other travel expenses. By strategically searching for flights with good redemption rates, we were able to book round-trip tickets for our entire family without spending a dime on the airfare, and we still had points left to spare.

We booked flights on Sun Country Airlines, which I had flown before and had no problems with. They’re based here in the Twin Cities and are a no frills, budget-friendly airline. They do charge extra for luggage, so we did have to pay fees for that, but the plane tickets themselves were free.

What About Other Travel Expenses?

We did have other travel expenses besides the flights. We had a rental car and a hotel, plus some food. I looked for other ways to save on those expenses. We used our Chase Sapphire card for the rental car, which I booked through AAA. As AAA members, we got a great rate, and we also benefited from their perk of including a second driver at no extra cost.

I am enrolled in a variety of hotel rewards programs, which are free. As a Best Western rewards member, I found a promotion that we used – stay 3 nights, get a bonus 10,000 points, which will be helpful for a future stay!

For food, the hotel included free breakfast, plus we ate a lot at my dad’s house. There was a Walmart nearby that we shopped at too.

Final Thoughts: Is It Worth It?

Absolutely! Thanks to careful planning and responsible credit card use, we turned everyday spending into 4 free flights. And we had a great trip. In addition to visiting family, we enjoyed Lake Tahoe, Reno and other Nevada sites, like Sand Mountain.

Of course, this is just the beginning. We’ve already earned another 20,000+ points just from regular purchases and are hoping to enjoy another frugal vacation soon.

If you’re looking for a way to save on travel, consider leveraging credit card rewards. Just remember to:

✔ Choose a card with a valuable sign-up bonus

✔ Time your application around planned expenses

✔ Use the card for everyday spending while staying within budget

✔ Pay off the balance in full each month to avoid interest charges

✔ Take advantage of travel portals for the best redemption value

With the right strategy, free travel isn’t just possible—it’s completely doable!

My Favorite Travel Credit Card

Want to get FREE airline flights and hotel rooms? Plus free travel insurance and other deals?

Here’s my best travel hacking tip: Get the Chase Sapphire credit card!

- Earn points for travel that you can use for free airline flights, hotel rooms, Airbnbs, rental cars and other travel expenses

- Earn 3x the points when you use it for travel expenses

- It includes FREE travel insurance so you don’t need to pay for that for any expense you book with the card

- Roadside assistance (for an extra fee)

- Exclusive deals

- $50 (or more) Chase Travel Hotel Credit every year

- MANY MORE PERKS!

Worried about how you can spend $5000 in 3 months? Here’s what we did to reach the minimum:

- I added my husband as a card user

- We waited until we knew we would have some big expenses, like new tires and appliances

- Use it for whatever else you can – even just grocery shopping. Then just pay it off right away! You don’t have to wait until you get the bill.

- We pay off the bill in full before it’s due to avoid paying any interest

- We reached our goal within 2 months!

Sign up here!

Have you used credit card points for travel? Share your experience in the comments below!

My Son’s First Plane Experience

My son has special needs and this trip was his first experience flying. Thanks to Navigating MSP, a free program at the Minneapolis/St. Paul airport, we could give him a practice run-through and prepare for our actual flights. Read more about our experience here!

This post was originally published on Feb 7, 2025 .

(Disclosure: This post contains referral links that give me bonus points if you sign up, at no cost to you. All opinions are 100% mine.)